44 duration for zero coupon bond

duration of zero coupon bonds | Forum | Bionic Turtle With respect to a zero coupon bond, Macaulay duration = maturity, and therefore must be a monotonically increasing function of maturity. On the other hand, DV01 of a zero (or deeply discounted) is not strictly increasing as DV01 = P*D/10,000 and the numerator has offsetting effects. If you'd kindly reference, I can fix? Thanks! Apr 7, 2012 #3 S What is the duration of a zero coupon bond? - Quora Zero coupon bond can be of any duration , can be from one year to 10 years. It is ordinarily from 3 to 5 years. Zero coupon bonds are issued at a discount with par value paid on redemption, sometimes with a nominal premium.

Macaulay Duration - Overview, How To Calculate, Factors Therefore, the Modified duration of the bond is 1.868 (1.915 / 1.025). It means for each percentage increase (decrease) in the interest rate, the price of the bond will fall (raise) by 1.868%.

Duration for zero coupon bond

Zero Coupon Bond - Investor.gov The maturity dates on zero coupon bonds are usually long-term—many don’t mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a long-range goal, such as paying for a child’s college education. With the deep discount, an investor can put up a small amount of money that can grow over many years. Bond Duration Calculator - Macaulay and Modified Duration ... Formula for Macaulay Duration The Macaulay duration formula (written as a series) is: \frac { 1*\frac {Payment_1} { (1+yield)^1} + 2*\frac {Payment_2} { (1+yield)^2} +...+ (n-1)*\frac {Payment_ {n-1}} { (1+yield)^ {n-1}} + n*\frac {Payment_n+Par\ Value} { (1+yield)^n} } {Current\ Price} C urrent P rice1 ∗ (1+yield)1P ayment1 The Macaulay Duration of a Zero-Coupon Bond in Excel ... To compensate for the lack of coupon payment, a zero-coupon bond typically trades at a discount, enabling traders and investors to profit at its maturity date, when the bond is redeemed at its face value. The Formula For Macaulay Duration Macaulay Duration = ∑ i n t i × P V i V where: t i = The time until the i th cash flow from the asset will be

Duration for zero coupon bond. The duration of a zero coupon bond is equal to the ... The duration of a zero-coupon bond is equal to the maturity of that bond. For example, suppose we have a zero-coupon bond with 2 years to maturity trading at a YTM of 25%. If you calculate the duration you will find that it will be equal to two years. 3.7.4. Duration of an irredeemable bond. An irredeemable bond is a perpetuity. What is the duration of a zero coupon bond? - Quora Originally Answered: what is the duration of a zero coupon bond? Zero coupon bond can be of any duration , can be from one year to 10 years. It is ordinarily from 3 to 5 years. Zero coupon bonds are issued at a discount with par value paid on redemption, sometimes with a nominal premium. The Macaulay Duration of a Zero-Coupon Bond in Excel The Macaulay duration can be viewed as the economic balance point of a group of cash flows. Another way to interpret the statistic is that it is the weightedaverage number of years an investor must maintain a position in the bond until the present value of the bond's cash flows equals the amount paid for the bond. What is the duration of a bond? and How to Calculate It ... Duration of a Bond. The duration of a bond does not represent the duration for which an investor holds a bond. Instead, it refers to the relationship between the price of a bond and interest rates of the bond after considering its different characteristics such as yield, coupon rate, maturity, etc.

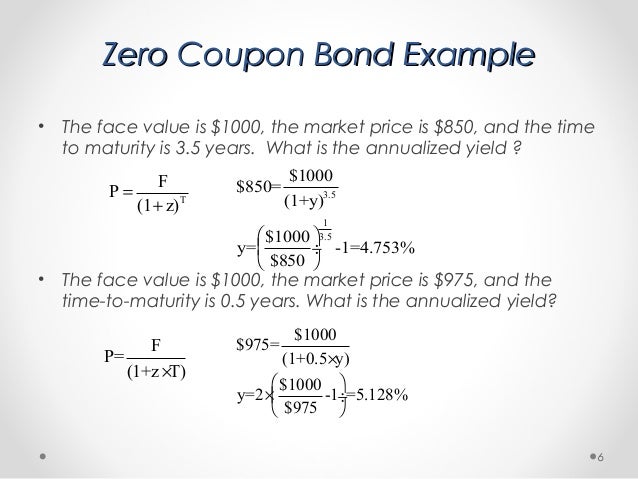

Macaulay's Duration | Formula | Example Duration of Bond A is 4.5, i.e. the maturity period (in years) of the zero-coupon bond. Duration of Bond B is calculated by first finding the present value of each of the annual coupons and maturity value. Annual coupon is $50 (i.e. 5% of the $1,000) and the maturity value is $1,000. PDF Understanding Duration - BlackRock duration can help predict the likely change in the price of a bond given achange in interest rates. as a general rule, for every 1% increase or decreasein interest rates, a bond's price will change approximately 1% in the oppositedirection for every year of duration. for example, if a bond has a duration of 5 years, and interest rates increase by … What Is Duration of a Bond? - TheStreet Definition - TheStreet Zero-Coupon Bonds. The easiest duration to calculate is that of a zero-coupon bond. This bond has zero yield, which means it does not pay any interest. Its duration is equal to its time to maturity. Zero Coupon Bond Value Calculator: Calculate Price, Yield ... Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months.

Zero Coupon Bond Calculator - MiniWebtool The Zero Coupon Bond Calculator is used to calculate the zero-coupon bond value. Zero Coupon Bond Definition. A zero-coupon bond is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments. When the bond reaches maturity, its investor receives its face value. fixed income - Duration of callable zero coupon bond ... A 10-year zero coupon bond is callable annually at par (its face value) starting at the beginning of year 6. Assume a flat yield curve of 10%. What is the bond duration? A- 10 Years B- 5 Years C- 7.5 Years D- Cannot be determined based on the data given. According to me it should be 10 years as the duration of a zero coupon bond is always equal ... Solved What will be the duration of a zero coupon bond ... See the answer What will be the duration of a zero coupon bond maturing in 5 years. Would the duration of the zero coupon bond be lower or higher than that of a 10% coupon bond maturing in 5 years. Provide a brief reasoning. Expert Answer 100% (1 rating) ANSWER - Duration of Zero coupon bond (ZCB) is the maturity time of the bond is 5 years. Zero Duration ETF List - ETFdb.com Zero Duration and all other bond durations are ranked based on their aggregate 3-month fund flows for all U.S.-listed bond ETFs that are classified by ETF Database as being mostly exposed to those respective bond durations. 3-month fund flows is a metric that can be used to gauge the perceived popularity amongst investors of Zero Duration ...

PDF APPENDIX 3A: Duration and Immunization maturity and duration zero-coupon bond or a coupon bond with a five-year duration, the FI would produce a $1,469 cash flow in five years, no matter what happens to interest rates in the immediate future. Next we consider the two strategies: buying five-year deep-discount bonds and buying five-year duration coupon bonds.

Zero Coupon Bond - WallStreetMojo These Bonds are initially sold at a price below the par value at a significant discount, and that’s why the name Pure Discount Bonds referred to above is also used for this Bonds. Since there are no intermediate cash flows associated with such Bonds, these types of bondsTypes Of BondsBonds refer to the debt instruments issued by governments or corp...

Post a Comment for "44 duration for zero coupon bond"