44 yield of zero coupon bond

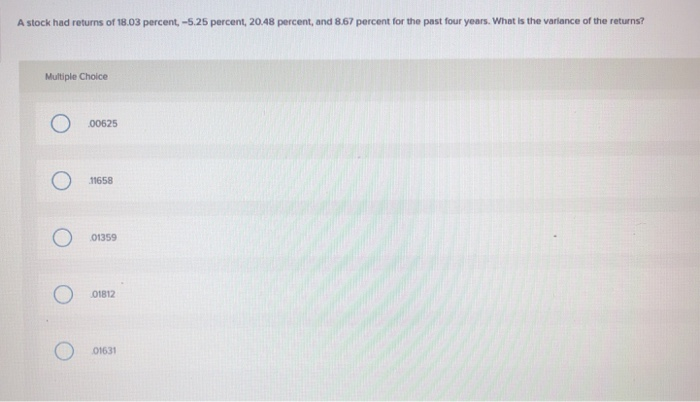

E the yield on three year zero coupon bonds is 3 and e. The yield on three-year zero-coupon bonds is 3% and the yield on one-year zero-coupon bonds is 2%. Investors expect that in two years, the yield on three-year zero-coupon bonds will still be 3% but the yield on one-year zero-coupon bonds will be 1%. What is the expected annualized holding period return (ann. HPR) of an investor who buys a three-year bond and sells it in two years? Zero-Coupon Bond Definition - Investopedia The interest earned on a zero-coupon bond is an imputed interest, meaning that it is an estimated interest rate for the bond and not an established interest rate. For example, a bond with a face...

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter Zero-Coupon Bond Yield = F 1/n PV - 1 Here; F represents the Face or Par Value PV represents the Present Value n represents the number of periods I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond.

Yield of zero coupon bond

US Treasury Zero-Coupon Yield Curve US Treasury Zero-Coupon Yield Curve From the data product: US Federal Reserve Data Releases (60,282 datasets) Refreshed an hour ago, on 24 May 2022 Frequency daily Description These yield curves... Zero-Coupon Bond Yield - Harbourfront Technologies Zero-Coupon Bond Yield = [Face Value / P]^1/n - 1 Zero-Coupon Bond Yield = [$1,000 / $900]^ (1/5) - 1 Zero-Coupon Bond Yield = 0.02129 or 2.13% Conclusion Zero-coupon bonds do not come with any coupon rates or payments. However, they come with high initial discounts with the promise of providing a higher face value to investors. Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years.

Yield of zero coupon bond. Zero Coupon Bond Yield Calculator - Find Formula, Example & more The yield of the bond will be. The formula is: Zero Coupon Bond Effective Yield = ( (Face Value of Bond / Present Value of Bond) ^ (1 / Period)) - 1. The process of solution we need to use is: Zero Coupon Bond Effective Yield = ( (1000 / 700) ^ (1 / 5)) - 1. Here, the bond will provide the investor with a yield of 7.39%. Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest How to Calculate the Yield of a Zero Coupon Bond Using Forward Rates? Then now we just subtract 1 from each side so that's gonna give us 0.066 is equal to our yield to maturity on a five-year zero-coupon bond and another way of expressing that 0.066 is 6.6% that's the same thing it's just our way of expressing that decimal. How do I Calculate Zero Coupon Bond Yield? (with picture) The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check.

United States - Zero-coupon yield bond - USA 10-year Zero coupon Yield ... United States - Zero-coupon yield bond - USA 10-year Zero coupon Yield Curve - Yield, end of period - US dollar, provided by Reuters Unit Percent per annum Dataset: FM : Financial market data Data Structure Definition (DSD) Metadata page (Series and Dataset Level Information) ... What Is a Zero Coupon Yield Curve? (with picture) The reason for constructing a zero coupon yield curve is for use as a basic tool in determining the price of many fixed income securities. A zero coupon bond does not pay interest but instead carries a discount to its face value. The investor therefore receives one payment of the face value of the bond on its maturity. Value and Yield of a Zero-Coupon Bond | Formula & Example The forecasted yield on the bonds as at 31 December 20X3 is 6.8%. Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value of Total Holding = 100 × $553.17 = $55,317 Expected accrued income = Value at the end of a period − Value at the start of a period How to Calculate Yield to Maturity of a Zero-Coupon Bond The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a...

Zero Coupon Yield Curve - The Thai Bond Market Association Zero Coupon Yield Curve 0 10 20 30 40 50 60 TTM (yrs.) 0.00 1.00 2.00 3.00 4.00 5.00 6.00 Yield (%) ThaiBMA Zero Coupon Yield Curve as of Tuesday, May 3, 2022 ThaiBMA Government Bond Yield Curve as of 03 May 2022 Export to Excel Remark: 1. Yield To Maturity Zero Coupon Bond Price Yield To Maturity Zero Coupon Bond Price, new checking account deals 2020, tasty house castle rock coupon code, jeff deals cadillac Show Promo Code Capture lifetime memories with an in-studio photography shoot for family photos, birthdays, and more; includes prints of one pose India Government Bonds - Yields Curve The India 10Y Government Bond has a 7.386% yield. 10 Years vs 2 Years bond spread is 106.3 bp. ... The highlighted column refers to the zero coupon bond. Click on for a forecast of the yield. If data are not all visible, swipe table left. Residual Maturity Yield Bond Price - with different Coupon Rates Fx; 0% 1% 3% 5% 7% 9%; Zero Coupon Bonds India- Invest in Zero Coupon Bonds A zero coupon bond is a debt instrument wherein the issuer does not make any coupon payment but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value. A zero-coupon bond will usually have higher returns than a regular bond with the same maturity because of the shape of the yield ...

Zero Coupon Bond Yield Calculator - YTM of a discount bond Zero Coupon Bond Yield Calculator A Zero Coupon Bond or a Deep Discount Bond is a bond that does not pay periodic coupon or interest. These bonds are issued at a discount to their face value and therefore the difference between the face value of the bond and its issue price represents the interest yield of the bond.

Bonds Flashcards | Quizlet A zero-coupon bond has a yield to maturity of 9% and a par value of $1,000. If the bond matures in eight years, the bond should sell for a price of _____ today. ... a 15-year zero-coupon bond that has a par value of $1,000, and a required return of 8% would be priced at approximately A. $308. B. $315. C. $464. D. $555. E. None of the options

What is a Zero-Coupon Bond? Definition, Features, Advantages, Calculation, Example, Limitations ...

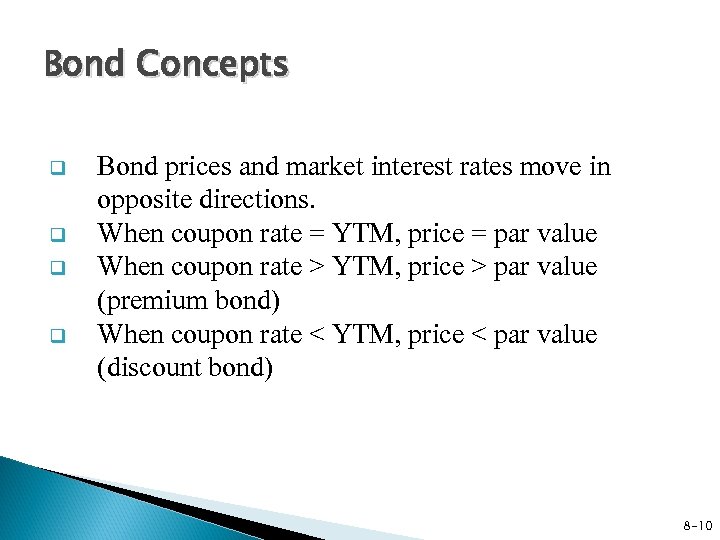

Bond Economics: Primer: Par And Zero Coupon Yield Curves Primer: Par And Zero Coupon Yield Curves. Par and zero coupon curves are two common ways of specifying a yield curve. Par coupon yields are quite often encountered in economic analysis of bond yields, such as the Fed H.15 yield series. Zero coupon curves are a building block for interest rate pricers, but they are less commonly encountered away ...

Bootstrapping | How to Construct a Zero Coupon Yield Curve in Excel? The annual coupon payment is depicted by multiplying the bond's face value with the coupon rate. read more. Hence, the spot rate for the 6-month zero-coupon bond Zero-coupon Bond In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a discount to its par ...

6) You purchased a zero-coupon bond one year ago for $276.83. The market interest rate is now 7 ...

Bond Yield to Maturity (YTM) Calculator - DQYDJ A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600; Par Value: $1000; Years to Maturity: 3;

Par Yield, Bond Yield and Zero Rate - Quantitative Finance Stack Exchange the answer is : The par yield is the yield on a coupon-bearing bond. The zero rate is the yield on a zero-coupon bond. When the yield curve is upward sloping, the yield on an N-year coupon-bearingbond is less than the yield on an N-year zero-coupon bond. This is because the coupons are discounted at a lower rate than the N-year rate and drag ...

Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10) Graph and download economic data for Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10) from 1990-01-02 to 2022-05-20 about 10-year, bonds, yield, interest rate, interest, rate, and USA.

Zero Coupon Bond Formula : Accounts and Finance Formulas / Its yield results from the difference ...

Zero Coupon Bond Yield - Formula (with Calculator) The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top

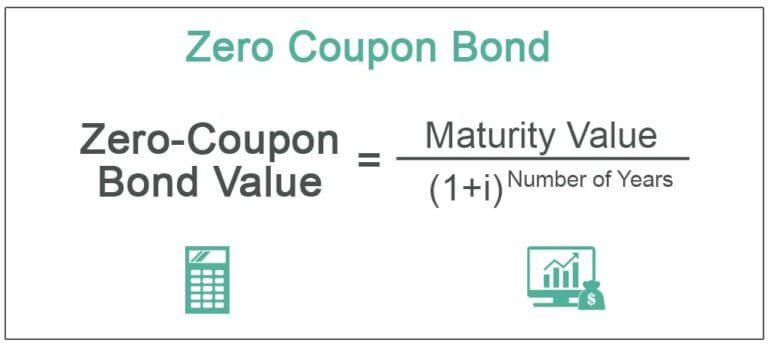

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

Zero-Coupon Bond: Formula and Excel Calculator To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years.

Zero-Coupon Bond Yield - Harbourfront Technologies Zero-Coupon Bond Yield = [Face Value / P]^1/n - 1 Zero-Coupon Bond Yield = [$1,000 / $900]^ (1/5) - 1 Zero-Coupon Bond Yield = 0.02129 or 2.13% Conclusion Zero-coupon bonds do not come with any coupon rates or payments. However, they come with high initial discounts with the promise of providing a higher face value to investors.

Post a Comment for "44 yield of zero coupon bond"