40 difference between yield to maturity and coupon rate

SPHY: SPDR® Portfolio High Yield Bond ETF - SSGA A low cost ETF that seeks to offer exposure to over a trillion dollars of USD-denominated high yield debt The index includes publicly issued USD high yield bonds with a below investment grade rating, at least 18 months to final maturity at the time of issuance, at least one year to maturity, a fixed coupon, and a minimum amount outstanding of $250M S&P/LSTA U.S. Leveraged Loan 100 Index - S&P Global S&P/LSTA Leverage Loans Index Base Rate Update. Index-Linked Products SEE ALL. Product Name Product Type Country/Region Ticker; Invesco Senior Loan ETF: ETF: United States: BKLN: Invesco Senior Loan ETF CAD: ETF: Canada: BKL.C: Invesco Senior Loan ETF CAD Hedged: ETF: Canada: BKL.F: Invesco Senior Loan ETF USD: ETF: Canada: BKL.U: Research ...

Philippines Government Bonds - Yields Curve Philippines Yield Curve Analysis Normally, longer-duration interest rates are higher than short-duration. So, the yield curve normally slopes upward as duration increases. For this reason, the spread (i.e. the yield difference) between a longer and a shorter bond should be positive. If not, the yield curve can be flat or inverted.

Difference between yield to maturity and coupon rate

Turkey Government Bonds - Yields Curve The Turkey 10Y Government Bond has a 18.870% yield. 10 Years vs 2 Years bond spread is -568 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 14.00% (last modification in December 2021). The Turkey credit rating is B+, according to Standard & Poor's agency. Principal of a Bond | Definition | Finance Strategists The coupon rate is the percentage of the principal paid back to the investor as interest. Whatever the principal is, the coupon rate is a percentage of that value. The bond maturity date is the date on which the principal must be paid back to the bondholder. Malaysia Government Bonds - Yields Curve Malaysia Yield Curve Analysis Normally, longer-duration interest rates are higher than short-duration. So, the yield curve normally slopes upward as duration increases. For this reason, the spread (i.e. the yield difference) between a longer and a shorter bond should be positive. If not, the yield curve can be flat or inverted.

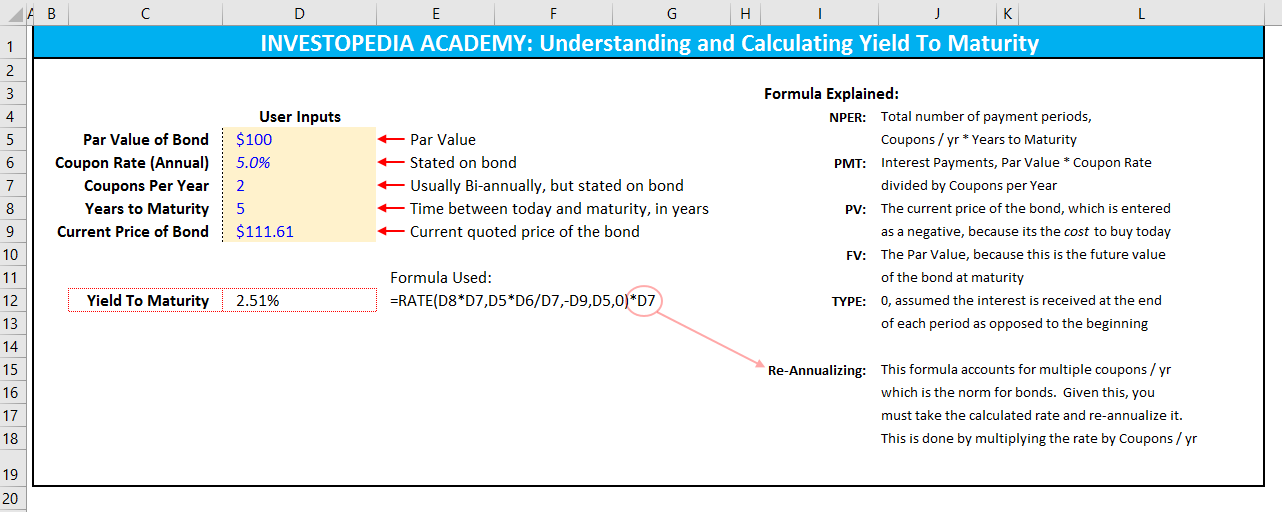

Difference between yield to maturity and coupon rate. I Bonds And TIPS Compared: Which Are A Better Buy? The inflation adjustment changes every six months and now generates an annualized 9.62%. That is, if you put in $10,000 now, you'll be credited $481 of interest for your first half year. In an era... › coupon-vs-yieldCoupon vs Yield | Top 5 Differences (with Infographics) Difference Between Coupon and Yield. Coupon refers to the amount which is paid as the return on the investment to the holder of the bond by bond issuer which remains unaffected by the fluctuations in purchase price whereas, yield refers to the interest rate on bond that is calculated on basis of the coupon payment of the bond as well as it current market price assuming bond is held till ... Treasury Return Calculator, With Coupon Reinvestment - DQYDJ Why does that matter? Using the 10 year yield at the 7 year mark assumes a flat yield curve. For an example of this method breaking down, see the constant maturity series for 1/02/2013 - the 10 year prevailing yield was 1.86%, but the 7 year yield was 1.25%. If you have yield curve data going back to 1871 feel free to excoriate me (just be sure ... › ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments.

South Africa Government Bonds - Yields Curve The South Africa 10Y Government Bond has a 10.375% yield. 10 Years vs 2 Years bond spread is 457 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 4.75% (last modification in May 2022). The South Africa credit rating is BB-, according to Standard & Poor's agency. U.S. 2 Year Treasury Note Overview (TMUBMUSD02Y) | Barron's Coupon Rate 2.500%. Maturity ... No data provided. Related Bonds - Maturity. Name. Price Change. Yield. ... of the next day's trading is calculated as the difference between the last trade and the ... Prospectus Filed Pursuant to Rule 424(b)(2) (424b2) The securities offer contingent coupon payments at an annualized rate that, if all are paid, would produce a yield that is generally higher than the yield on our conventional debt securities of the... investspectrum.com › uma › duration-vs-maturityDuration vs. Maturity and Why the Difference Matters Sep 01, 2017 · See the diagram below to understand the relationship between the bond’s price and its interest rate (or coupon rate). A bond is quoted with its “coupon yield”. This refers to the annual interest payable as a percent of the original face or par value. An 8% bond with a par value of 1000 would receive $80 per year. Coupon/Interest Rate= 8%

BlackRock Short Maturity Municipal Bond ETF | MEAR Average Yield to Maturity as of Jun 13, 2022 1.23% Tax Equiv. SEC Yield as of Jun 13, ... FX Rate Maturity Coupon (%) Mod. Duration Yield to Call (%) Yield to Worst (%) Real Duration ... (including timing differences between trade and settle dates of securities purchased by the funds). as of Jun 13, 2022 ... Pricing risk-based catastrophe bonds for earthquakes at an urban scale ... In presence of a coupon CAT bond and no triggering event, the bond holders receives the face value Z at the maturity time in addition to the coupon payments C paid annually (or at specific ... Lithuania Government Bonds - Yields Curve Lithuania Yield Curve Analysis Normally, longer-duration interest rates are higher than short-duration. So, the yield curve normally slopes upward as duration increases. For this reason, the spread (i.e. the yield difference) between a longer and a shorter bond should be positive. If not, the yield curve can be flat or inverted. iShares® iBonds® 2023 Term High Yield and Income ETF Get exposure to a diversified universe of high yield and BBB-rated corporate bonds maturing between January 1, 2023 and December 15, 2023 in a single fund. 2. Designed to mature like a bond, trade like a stock. Combine the defined maturity and regular income distribution characteristics of a bond with the transparency and tradability of a stock. 3.

Tips for beating inflation - The Royal Gazette | Bermuda News, Business ... At the same time, coupons earned on the principal value should grow commensurate with the increasing face value of the bonds. At maturity, Tips return the adjusted principal or the original...

dqydj.com › bond-yield-to-maturity-calculatorBond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity (Estimated) (%): The estimated yield to maturity using the shortcut equation explained below, so you can compare how the quick estimate would compare with the converged solution. Current Yield (%): Simple yield based upon current trading price and face value of the bond.

The price of frequent issuance: the value of information in the green ... The paper finds that around 8 basis points of the bond yield difference between frequent and infrequent issuers cannot be explained by common pricing factors such credit rating, maturity, coupon rates, and existing green bond labels.

Treasury Rates, Interest Rates, Yields - Barchart.com The difference between bills, notes and bonds are the length until maturity. Treasury bills (or T-Bills) mature in one year or less. Like zero-coupon bonds, they do not pay interest prior to maturity; instead they are sold at a discount of the par value to create a positive yield to maturity.

› knowledge-center › what-is-theWhat Is the Difference Between IRR and the Yield to Maturity? Mar 27, 2019 · Yield to maturity The biggest difference between IRR and yield to maturity is that the latter is talking about investments that have ... The bond's face value is $1,000 and its coupon rate is 6% ...

BIL: SPDR® Bloomberg 1-3 Month T-Bill ETF - SSGA The SPDR ® Bloomberg 1-3 Month T-Bill ETF seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the Bloomberg 1-3 Month U.S. Treasury Bill Index (the "Index"); Seeks to provide exposure to zero coupon U.S. Treasury securities that have a remaining maturity of 1-3 months; Short duration fixed income is less exposed to ...

Floating Rate Strategies - Institutional Class - Guggenheim Investments Yield To Maturity: 4.7: 5.4: Number of Holdings: 288: 1,674: Average Price: $97.0: $97.4: 30-Day Subsidized SEC Yield: ... Yield to maturity is the internal rate of return earned by an investor who buys the bond today at the market price, assuming that the bond will be held until maturity, and that all coupon and principal payments will be made ...

YIELD Function - Formula, Examples, Calculate Yield in Excel Maturity (required argument) - This is the maturity date of the security. It is the date when the security expires. Rate (required argument) - The annual coupon rate. Pr (required argument) - The price of the security per $100 face value. Redemption (required argument) - This is the redemption value per $100 face value.

Post a Comment for "40 difference between yield to maturity and coupon rate"