41 what is the duration of a zero coupon bond

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding What is the duration of a zero coupon bond? - Quora Zero coupon bond can be of any duration , can be from one year to 10 years. It is ordinarily from 3 to 5 years. Zero coupon bonds are issued at a discount with par value paid on redemption, sometimes with a nominal premium.

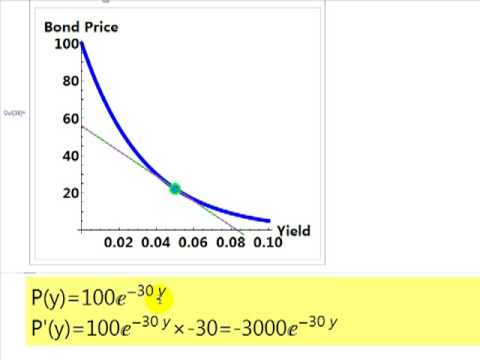

PDF Understanding Duration - BlackRock rates, duration allows for the effective comparison of bonds with different maturities and coupon rates. For example, a 5-year zero coupon bond may be more sensitive to interest rate changes than a 7-year bond with a 6% coupon. By comparing the bonds' durations, you may be able to anticipate the degree of

What is the duration of a zero coupon bond

The One-Minute Guide to Zero Coupon Bonds | FINRA.org After 20 years, the issuer of the bond pays you $10,000. For this reason, zero-coupon bonds are often purchased to meet a future expense such as college costs or an anticipated expenditure in retirement. Federal agencies, municipalities, financial institutions and corporations issue zero-coupon bonds. Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww Suitable Tenure for Zero Bond Coupon. The time and the maturity value of Zero Coupon bonds share a negative correlation. The longer until the maturity date, the less the investors have to pay for it. Therefore, the Zero Coupon bonds generally come with a time horizon of 10 to 15 years. On the other hand, these bonds with a time period of less ... Zero Coupon Bond | Investor.gov The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a long-range goal, such as paying for a child's college education. With the deep discount, an investor can put up a small amount of money that can grow over many years.

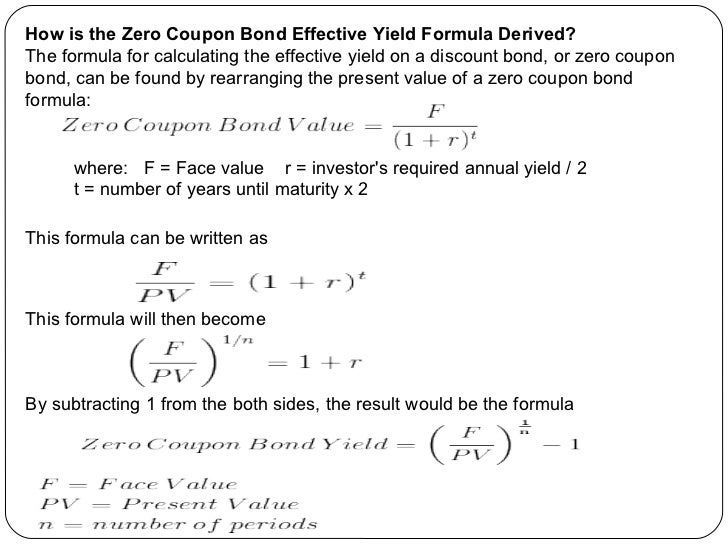

What is the duration of a zero coupon bond. What is zero coupon bonds? - myITreturn Help Center Zero-coupon bond (also discount bond or deep discount bond) is a bond bought or issued at a price lower than its face value and the face value repaid at the time of maturity. It does not make periodic interest (coupon) payments. Hence the term is called as zero-coupon bond. When the bond reaches maturity, its investors receive its par (or face ... Dollar Duration - Overview, Bond Risks, and Formulas Dollar duration can be applied to any fixed income products, including forwarding contracts, zero-coupon bonds, etc. Therefore, it can also be used to calculate the risk associated with such products. Summary Dollar duration is the measure of the change in the price of a bond for every 100 bps (basis points) of change in interest rates. Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. What is the duration of a zero-coupon bond that has eight years ... - Quora Answer (1 of 5): Macaulay duration is the weighted average time to cash flow, weighted by the present value of the cash flow. A zero-coupon bond only has one cash flow, so the Macaulay duration is equal to the time to cash flow, 8 years and 10 years in your question. The modified duration is the...

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter Both of these words represent the common zero coupon bond term. Zero Coupon bond is also named as accrual bond and it lacks the coupons or the installments procedure for making the payments; instead, a single payment at the level of maturity (the time period or the duration) is paid. What is the duration of a bond? and How to Calculate It? The simplified formula for Macaulay duration is as below: Macaulay Duration = Sum of PV of cash flows [PV (CF 1) + PV (CF 2) … + PV (CF n )] / Market price of the bond See also The Basel III Accord - What Is It? (Guidance) The cash flows of a bond consist of all interest payments and the final interest and principal payments made to the investors. Zero Coupon Bond | Investor.gov The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a long-range goal, such as paying for a child's college education. With the deep discount, an investor can put up a small amount of money that can grow over many years.

Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww Suitable Tenure for Zero Bond Coupon. The time and the maturity value of Zero Coupon bonds share a negative correlation. The longer until the maturity date, the less the investors have to pay for it. Therefore, the Zero Coupon bonds generally come with a time horizon of 10 to 15 years. On the other hand, these bonds with a time period of less ... The One-Minute Guide to Zero Coupon Bonds | FINRA.org After 20 years, the issuer of the bond pays you $10,000. For this reason, zero-coupon bonds are often purchased to meet a future expense such as college costs or an anticipated expenditure in retirement. Federal agencies, municipalities, financial institutions and corporations issue zero-coupon bonds.

Post a Comment for "41 what is the duration of a zero coupon bond"