41 coupon rate vs ytm

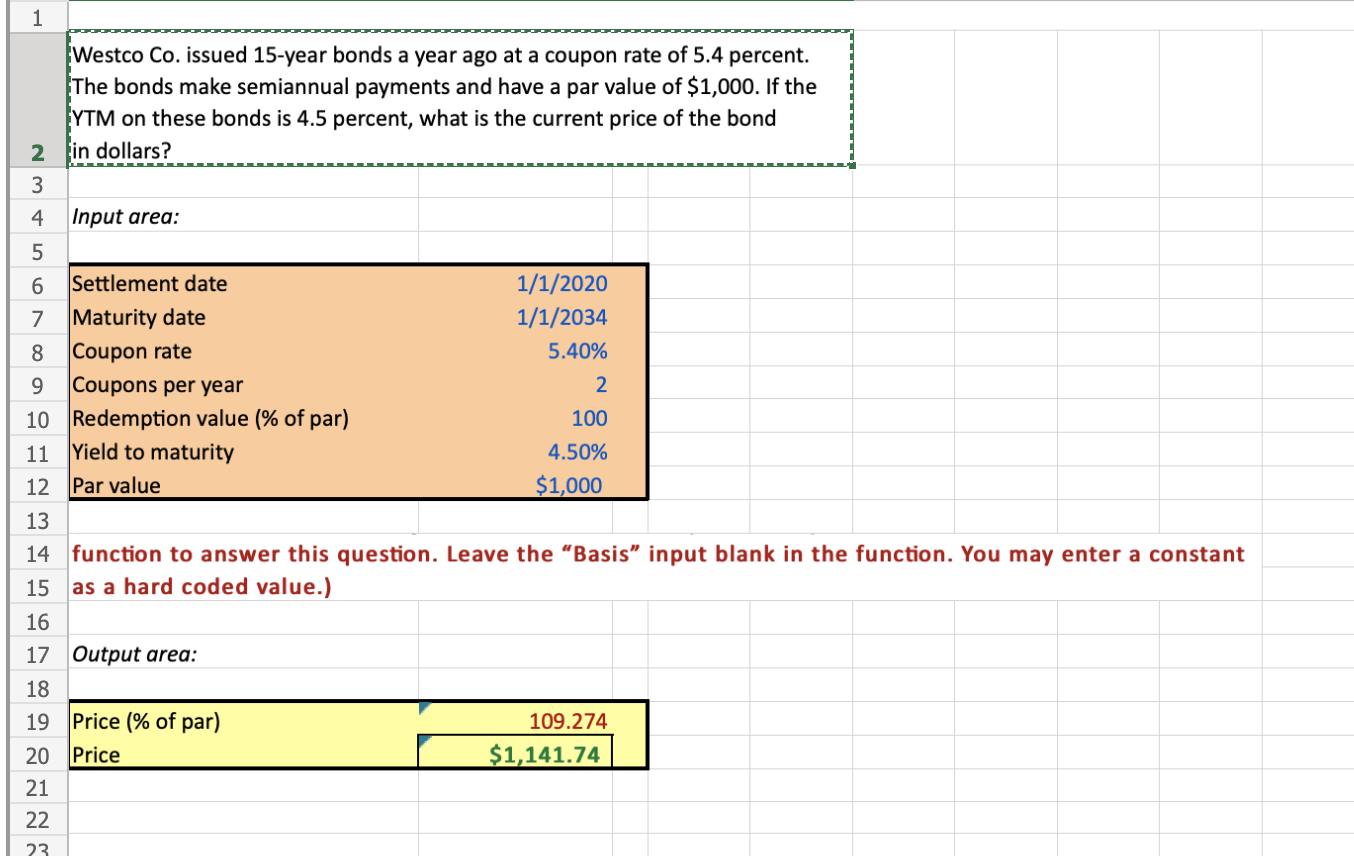

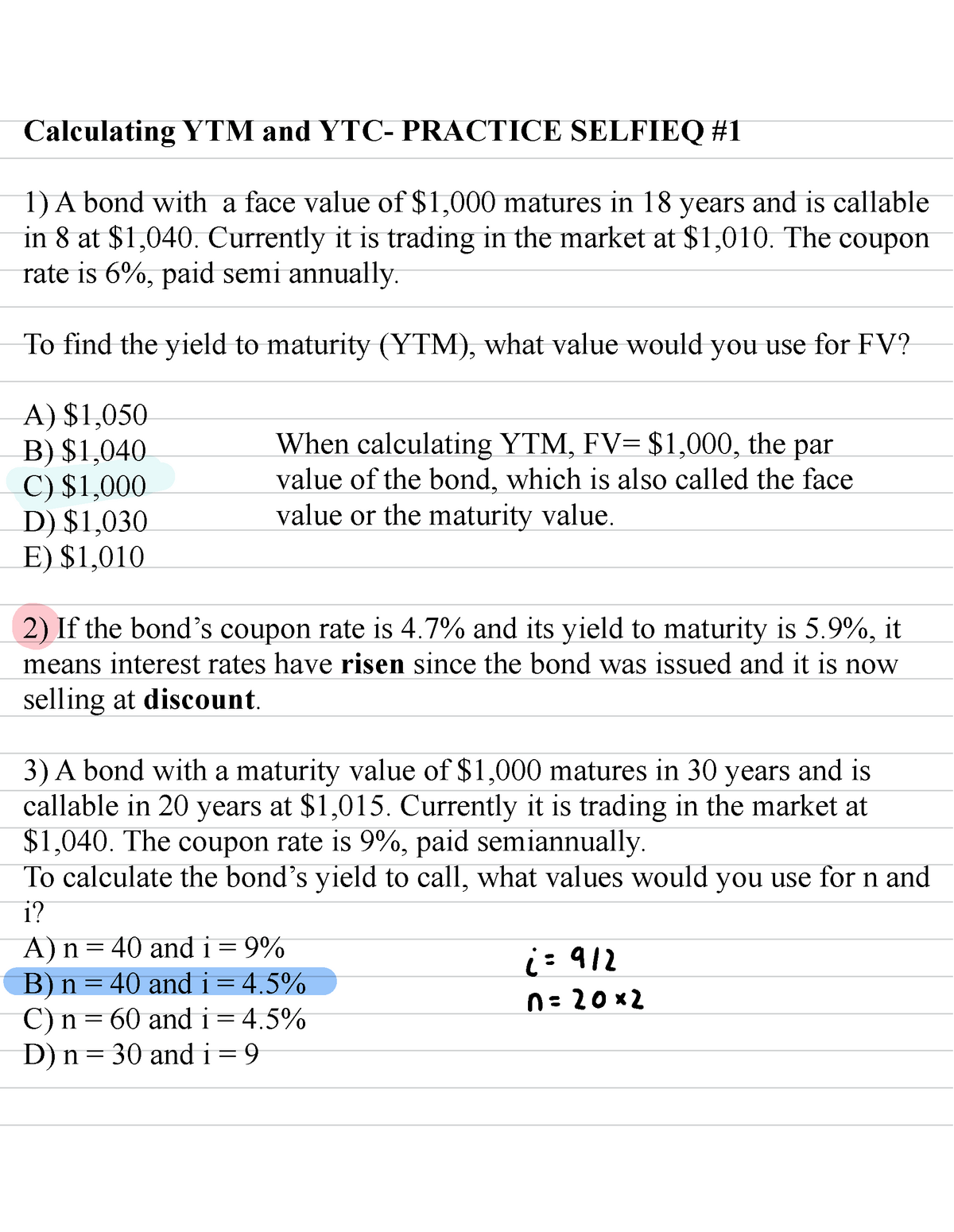

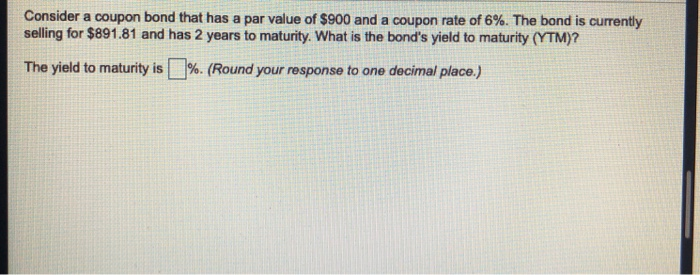

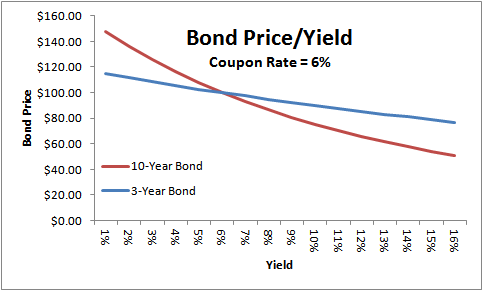

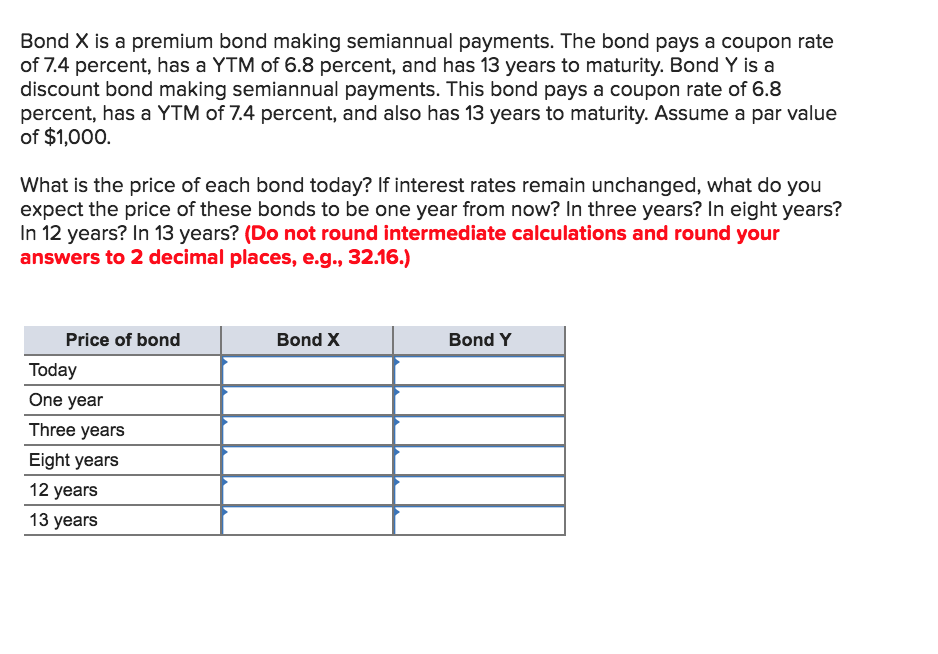

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. What is the difference between the YTM and the coupon rate? The coupon rate is the interest rate on the bond at the time of issue. The YTM or Yield to Maturity is the yield based on the current price of the bond. For example, if a $1000 bond maturing in 10 years is issued at 5%, then 5% is the coupon rate, which means it will always pay $50 per year until maturity.

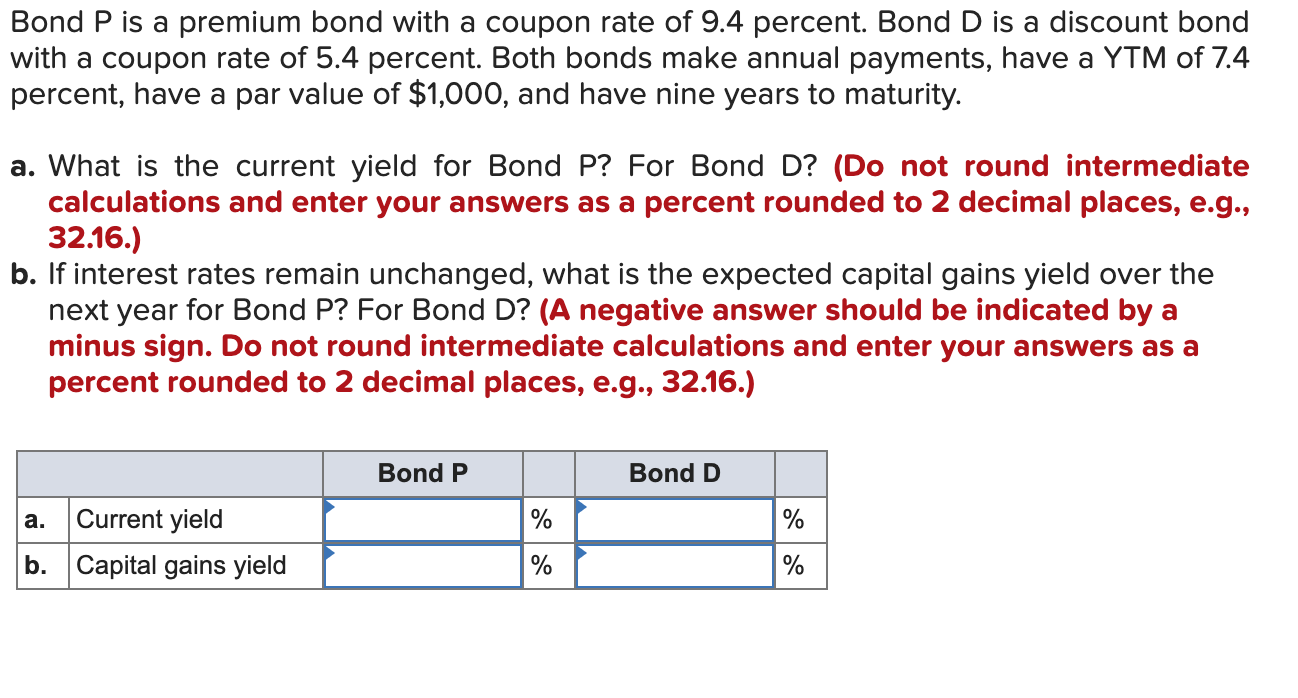

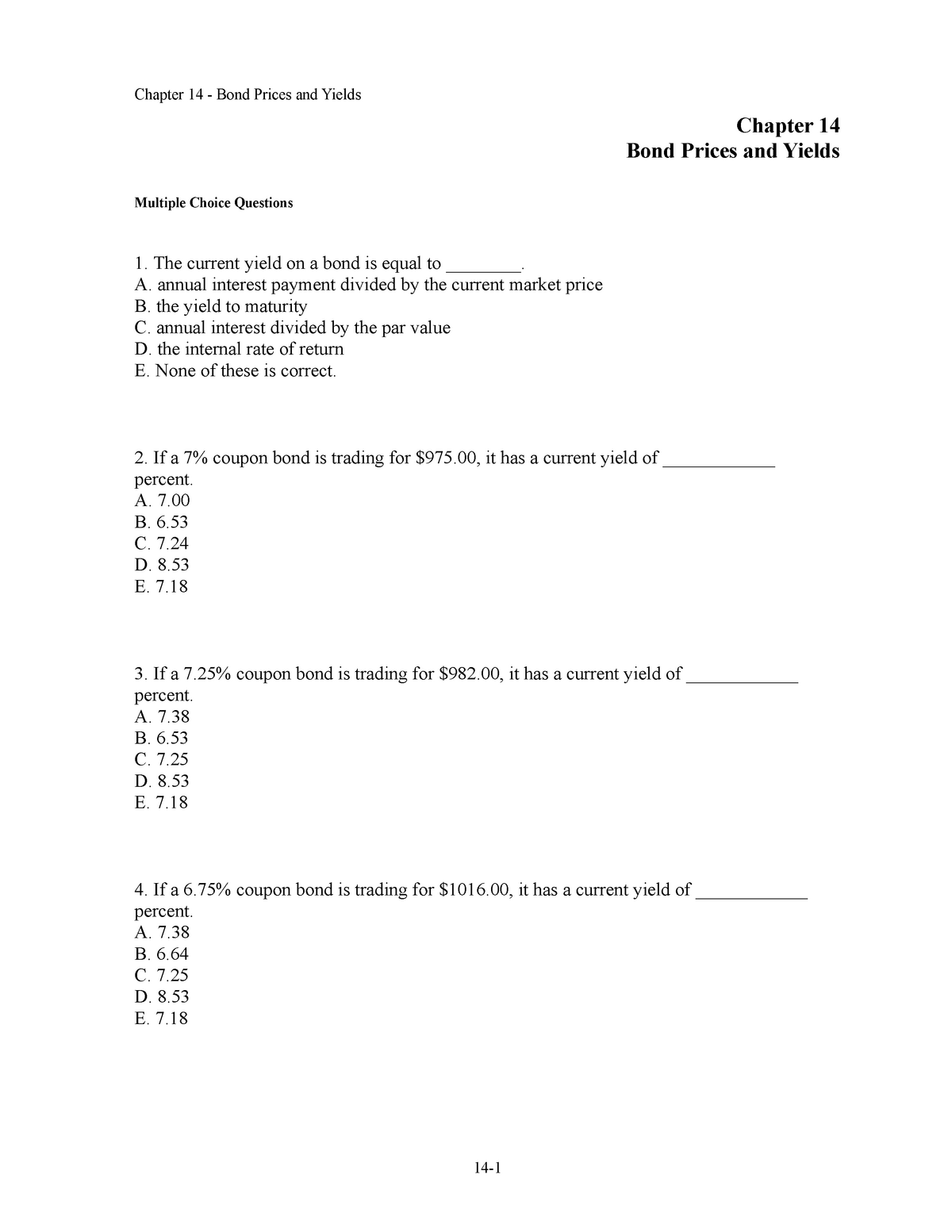

Yield to maturity - Wikipedia If a bond's coupon rate is more than its YTM, then the bond is selling at a premium. If a bond's coupon rate is equal to its YTM, then the bond is selling at par. Variants of yield to maturity [ edit] As some bonds have different characteristics, there are some variants of YTM:

Coupon rate vs ytm

Yield to Maturity vs Coupon Rate: What's the Difference While the coupon rate determines annual interest earnings, the yield to maturity determines how much you'll make back in interest throughout the bond's lifespan. The YTM considers market changes because, even though your bond's interest rate will not change, its value will fluctuate depending on the market's rates. Coupon Rate Calculator | Bond Coupon What is the difference between bond coupon rate and yield to maturity (YTM)? As we said above, the coupon rate is the product of the division of the annual coupon payment by the face value of the bond. It merely represents your annual return from your bond investments and does not tell you anything about the actual return of your investments. Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Therefore, if the 5-Year Treasury Yield becomes 4%, still the coupon rate will remain 5%, and if the 5-Year Treasury Yield increases to 12% yet, the coupon rate will remain 10%. Coupon Rate Vs. Yield to Maturity. Many people get confused between coupon rate and yield to maturity. In reality, both are very different measures of returns.

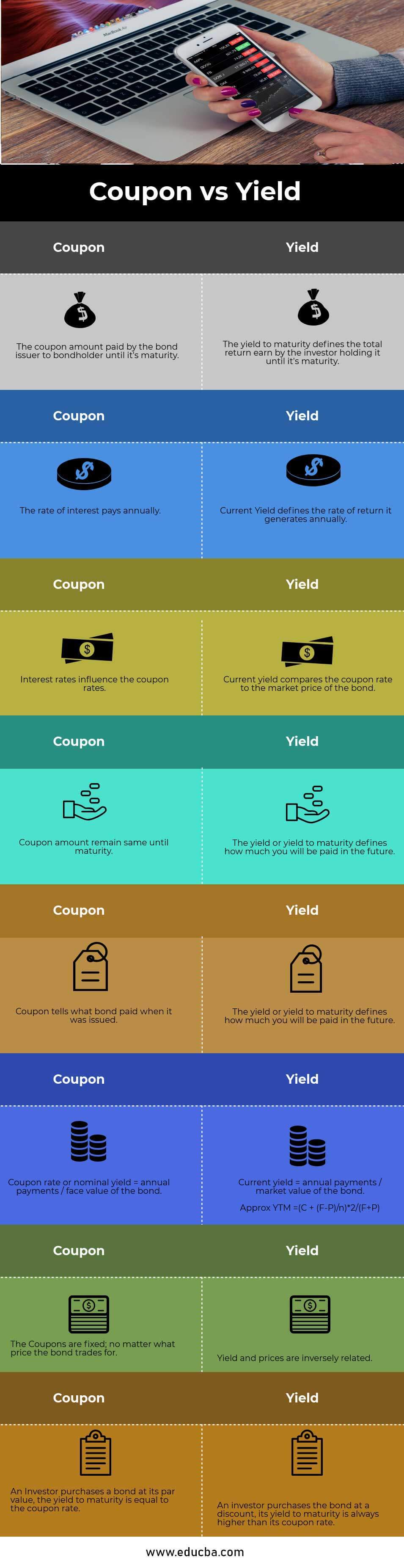

Coupon rate vs ytm. Yield to Maturity vs Coupon Rate - Speck & Company Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is bought by an investor and held to maturity. Coupon rate is a fixed value in relation to the face value of a bond. If yield to maturity is greater than the coupon rate, the bond is trading at a discount to its par value. Coupon Rate Formula | Step by Step Calculation (with Examples) Harry said that the coupon rate is 10.53% Annual Coupon Payment Annual coupon payment = 4 * Quarterly coupon payment = 4 * $25 = $100 Therefore, the coupon rate of the bond can be calculated using the above formula as, Coupon Rate of the Bond will be - Therefore, Dave is correct. Difference Between YTM and Coupon rates 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation. Author Recent Posts Ian Search DifferenceBetween.net : 9 Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo coupon refers to the amount which is paid as the return on the investment to the holder of the bond by bond issuer which remains unaffected by the fluctuations in purchase price whereas, yield refers to the interest rate on bond that is calculated on basis of the coupon payment of the bond as well as it current market price assuming bond is held …

Coupon Rate Vs Yield To Maturity - bizimkonak.com Yield To Maturity (YTM): Meaning & Coupon Rate Vs YTM Vs …. CODES. (5 days ago) Coupon Rate Vs YTM Vs Current Yield. 2.Coupon Rate- 8%. 3.Maturity Period- 5 years. Yields can be measured in multiple ways, out of which 3 most common measures are-If there …. Visit URL. What Is Coupon Rate and How Do You Calculate It? - SmartAsset Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. In our example above, the $1,000 pays a 10% interest rate. ... Yield to Maturity (YTM) - This is the total return investors earn when they hold the bond until it matures. Like the coupon or nominal yield, it's often quoted as an annual rate but ... Yield To Maturity(YTM): Meaning & Coupon Rate Vs YTM Vs Current Yield ... Coupon Rate Vs YTM Vs Current Yield. Before we move further, let us understand that when you purchase a bond, there are three things that are fixed, given below with examples-1.Face Value- Rs 1000. 2.Coupon Rate- 8%. 3.Maturity Period- 5 years. Yields can be measured in multiple ways, out of which 3 most common measures are- YTM: Formula and Calculator (Step-by-Step) - Wall Street Prep Assumption #3 → The coupon payments were reinvested at the same rate as the yield-to-maturity (YTM). Said differently, the yield to maturity (YTM) on a bond is its internal rate of return (IRR) - i.e. the discount rate which makes the present value (PV) of all the bond's future cash flows equal to its current market price.

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia The yield to maturity (YTM) is an estimated rate of return. It assumes that the buyer of the bond will hold it until its maturity date, and will reinvest each interest payment at the same... Current Yield vs. Yield to Maturity: What's the Difference? Yield to maturity is a way to compare bonds with different market prices, coupon rates, and maturities. Formula The current yield of a bond is easily calculated by dividing the coupon payment by the price. For example, a bond with a market price of $7,000 that pays $70 per year would have a current yield of 7%. 3 What is a Coupon Rate? | Bond Investing | Investment U For long-term investors, coupon rate is a more important factor than YTM. This is because they're more likely to depend on the interest payouts of the bond. Therefore, a higher coupon means a higher payment. Conversely, bond traders prefer YTM because they're acquiring bonds in a secondary market, where carrying value matters more. Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia The current yield compares the coupon rate to the current market price of the bond. 2 Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is also 6%....

Coupon Rate Vs YTM - YouTube Learn more about the difference between a coupon rate and a yield to maturity.Investor's Business Daily has been helping people invest smarter results by pro...

Important Differences Between Coupon and Yield to Maturity - The Balance Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate.

Difference Between Coupon Rate and Yield to Maturity The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value. In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. The Coupon Rate is said to be the same throughout the bond tenure year.

Difference Between Current Yield and Coupon Rate The main difference between current yield and coupon rate is that current yield is a ratio of annual income from the bond to the current price of the bond, and it tells about the expected income generated from the bond. In contrast, the coupon rate is a fixed interest paid by the issuer annually on the face value of a bond.

Coupon vs Yield | Top 8 Useful Differences (with Infographics) - EDUCBA The coupon rate of a bond is the amount of interest that is actually paid on the principal amount of the bond (at par). While yield to maturity defines that it's an investment that is held till the maturity date and the rate of return it will generate at the maturity date.

Coupon Rate vs Current Yield vs Yield to Maturity (YTM) - YouTube We also explain the difference between the face value and the market value of the bond and their relationship to the coupon rate, current yield, and yield to maturity (YTM). We go through...

Coupon Rate - What it is, Formula, & Example - Speck & Company Coupon Rate vs Yield to Maturity. Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is held to maturity. Since bonds do not always trade at face value, YTM gives investors a method to calculate the yield they can expect to earn on a bond if they held it until redemption.

What is the relationship between YTM and the discount rate of a ... - Quora Answer (1 of 3): They can be considered part of the same thing and depends on the type of bond. Yield to maturity is a concept for fixed rate bonds and is the internal rate of return i.e. the rate at which future flows are discounted on a compound basis to give the present value of the bond incl...

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Therefore, if the 5-Year Treasury Yield becomes 4%, still the coupon rate will remain 5%, and if the 5-Year Treasury Yield increases to 12% yet, the coupon rate will remain 10%. Coupon Rate Vs. Yield to Maturity. Many people get confused between coupon rate and yield to maturity. In reality, both are very different measures of returns.

Coupon Rate Calculator | Bond Coupon What is the difference between bond coupon rate and yield to maturity (YTM)? As we said above, the coupon rate is the product of the division of the annual coupon payment by the face value of the bond. It merely represents your annual return from your bond investments and does not tell you anything about the actual return of your investments.

Yield to Maturity vs Coupon Rate: What's the Difference While the coupon rate determines annual interest earnings, the yield to maturity determines how much you'll make back in interest throughout the bond's lifespan. The YTM considers market changes because, even though your bond's interest rate will not change, its value will fluctuate depending on the market's rates.

Post a Comment for "41 coupon rate vs ytm"