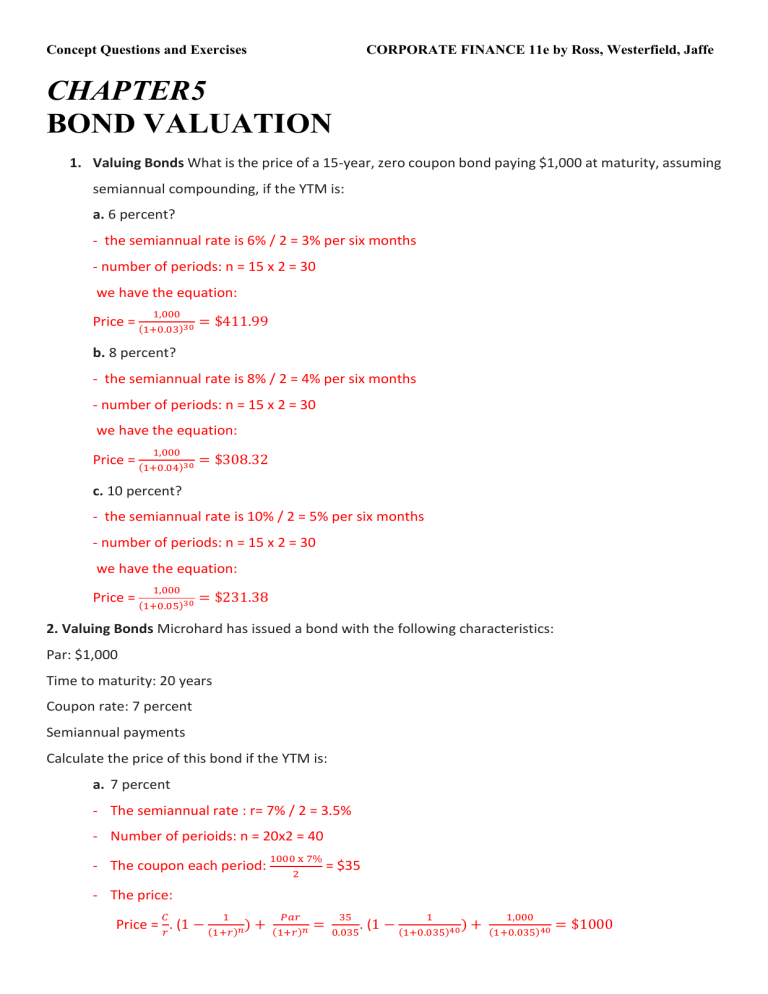

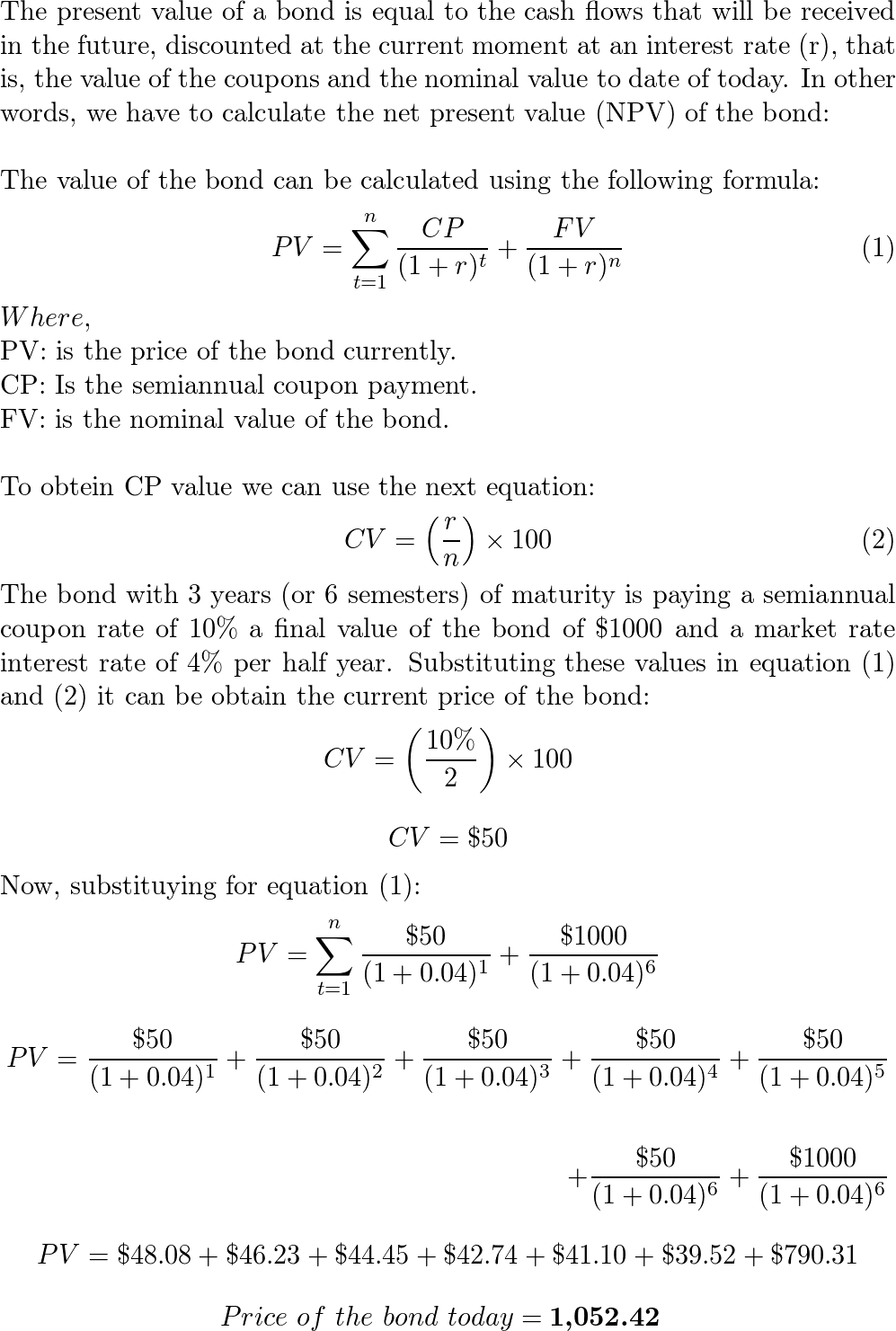

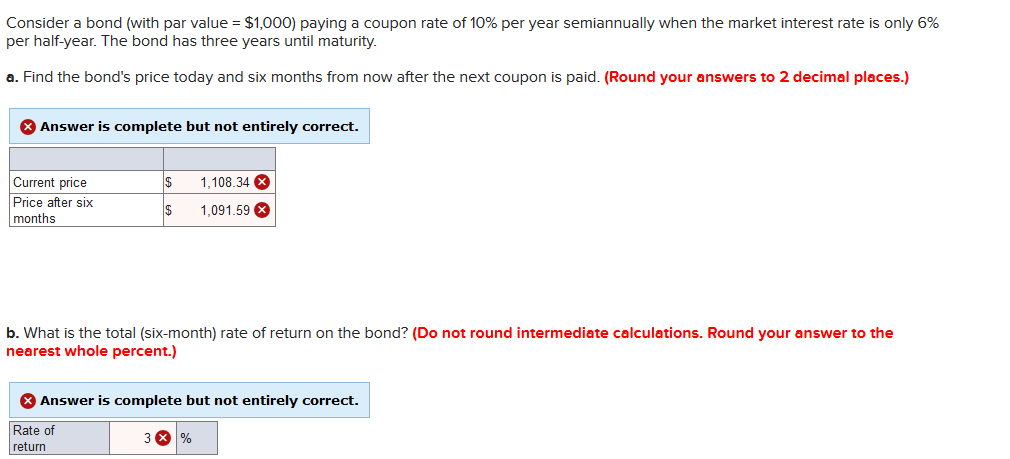

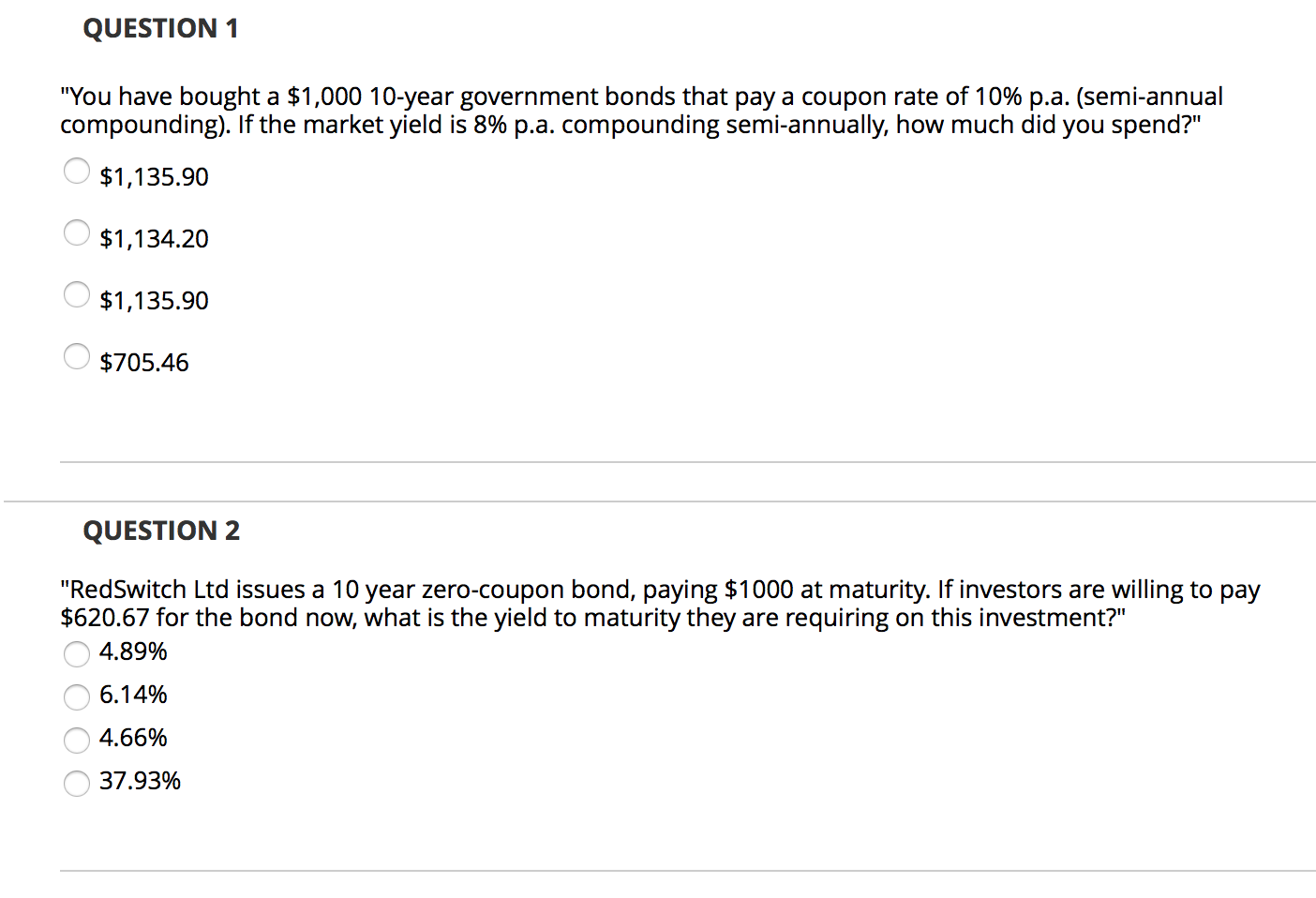

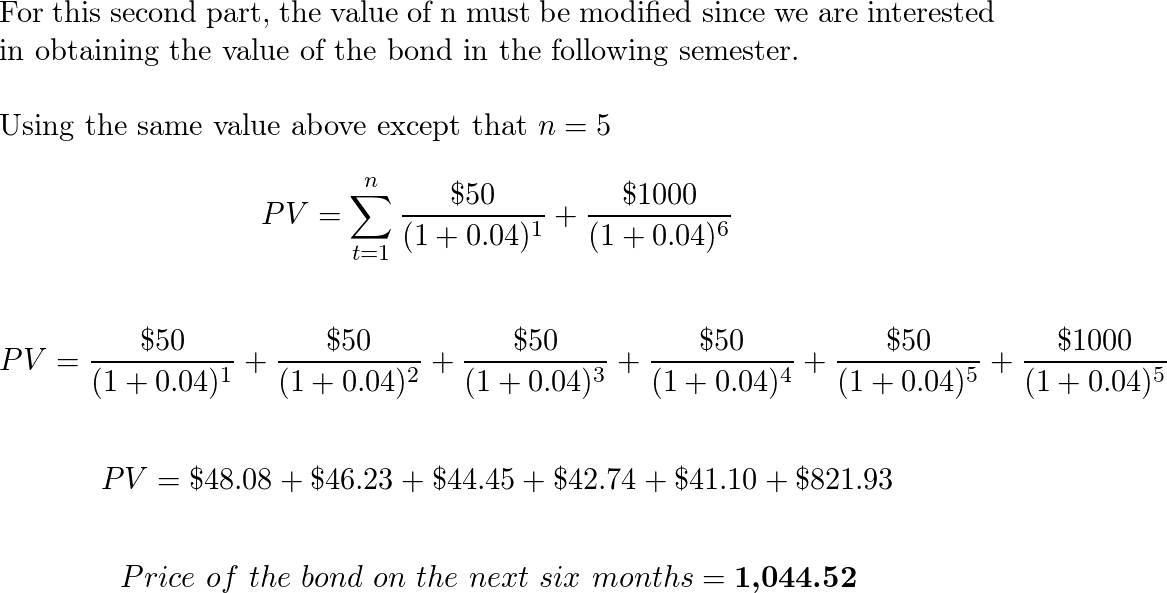

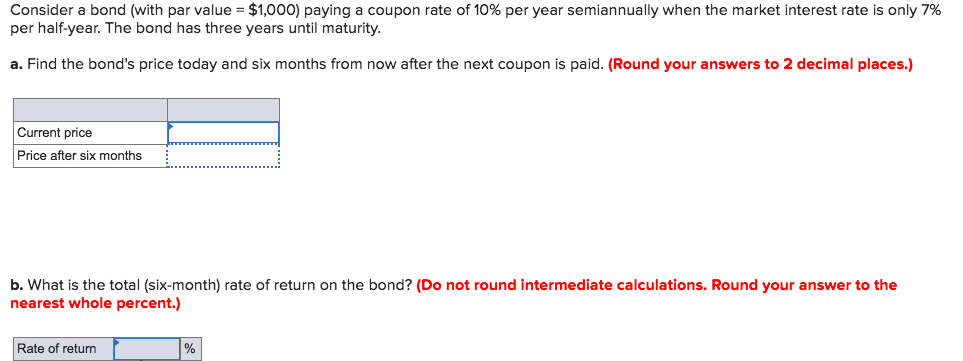

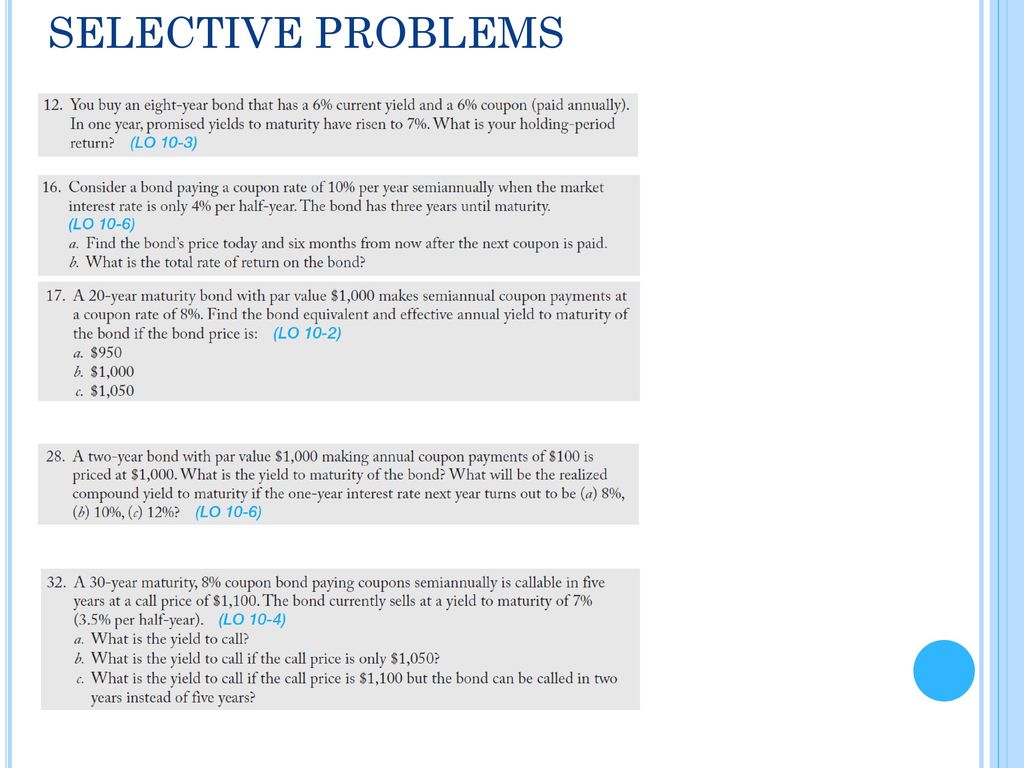

42 consider a bond paying a coupon rate of 10 per year semiannually when the market

› i-bond-returnsI Bond Returns: Almost Too Good To Be True - Financial Samurai Dec 15, 2021 · If someone bought I-Bond on Nov 10, 2019, their fixed rate is 0.2% and inflation rate will vary every 6 months there after, the calculation would follow this way, Nov 10 2019 to May 10, 2020: (0.2+1.01×2 Inflation Rate)=2.22% › irb › 2004-33_IRBInternal Revenue Bulletin: 2004-33 | Internal Revenue Service Aug 16, 2004 · On January 1, 2005, A, an individual, borrows money from BK, a bank, and signs a 10-year note bearing adequate stated interest, within the meaning of § 483.On January 1, 2005, A uses the proceeds of the loan to purchase Blackacre, rental real property.

› learn › storyBonds vs. Bond Funds: Which is Right for You? | Charles Schwab Jan 24, 2020 · Since bond mutual funds and ETFs own many securities, the impact of one bond default would likely be less than for an individual investor owning individual bonds. While some bond investments may be made in denominations as low as $1,000 per bond, the appropriate amount to invest is best determined by an individual's investing goals and objectives.

Consider a bond paying a coupon rate of 10 per year semiannually when the market

quizlet.com › 478580165 › fin4300-ch-7-smartbookFIN4300 Ch 7 Smartbook Flashcards | Quizlet You are in the 3rd year of a 10-year corporate bond has a 6% coupon, a call premium of $60, and a first call date in year 4. Market interest rates are 5.75% and are expected to drop dramatically for an extended period. If you plan to hold the bond, which yield should you most consider before buying the bond? › fintech › cfpb-funding-fintechU.S. appeals court says CFPB funding is unconstitutional ... Oct 20, 2022 · That means the impact could spread far beyond the agency’s payday lending rule. "The holding will call into question many other regulations that protect consumers with respect to credit cards, bank accounts, mortgage loans, debt collection, credit reports, and identity theft," tweeted Chris Peterson, a former enforcement attorney at the CFPB who is now a law professor at the University of Utah. › fixed-income-bonds › compareCompare Income Products - Bonds, CDs, Money Market Funds ... Money market funds aim to protect your principal, but they are not insured and do not come with any guarantee. You can buy or sell shares in a money market fund daily. 0.18%–0.55% in gross expense ratio per year 2: Many funds with $0 minimum investment - otherwise $10,000 to $10 million. Fixed income ETFs

Consider a bond paying a coupon rate of 10 per year semiannually when the market. › securities › treasury-bondsTreasury Bonds | CBK If the bond has a pre-determined coupon rate in the prospectus, you should choose Non-Competitive/Average Rate. If the prospectus says that the coupon rate is market determined, you can select either the Interest/Competitive Rate or the Non-Competitive/Average Rate. Investors choosing the Interest/Competitive Rate bid on the bonds by submitting ... › fixed-income-bonds › compareCompare Income Products - Bonds, CDs, Money Market Funds ... Money market funds aim to protect your principal, but they are not insured and do not come with any guarantee. You can buy or sell shares in a money market fund daily. 0.18%–0.55% in gross expense ratio per year 2: Many funds with $0 minimum investment - otherwise $10,000 to $10 million. Fixed income ETFs › fintech › cfpb-funding-fintechU.S. appeals court says CFPB funding is unconstitutional ... Oct 20, 2022 · That means the impact could spread far beyond the agency’s payday lending rule. "The holding will call into question many other regulations that protect consumers with respect to credit cards, bank accounts, mortgage loans, debt collection, credit reports, and identity theft," tweeted Chris Peterson, a former enforcement attorney at the CFPB who is now a law professor at the University of Utah. quizlet.com › 478580165 › fin4300-ch-7-smartbookFIN4300 Ch 7 Smartbook Flashcards | Quizlet You are in the 3rd year of a 10-year corporate bond has a 6% coupon, a call premium of $60, and a first call date in year 4. Market interest rates are 5.75% and are expected to drop dramatically for an extended period. If you plan to hold the bond, which yield should you most consider before buying the bond?

Post a Comment for "42 consider a bond paying a coupon rate of 10 per year semiannually when the market"